Disruption of Auto Lending Industry

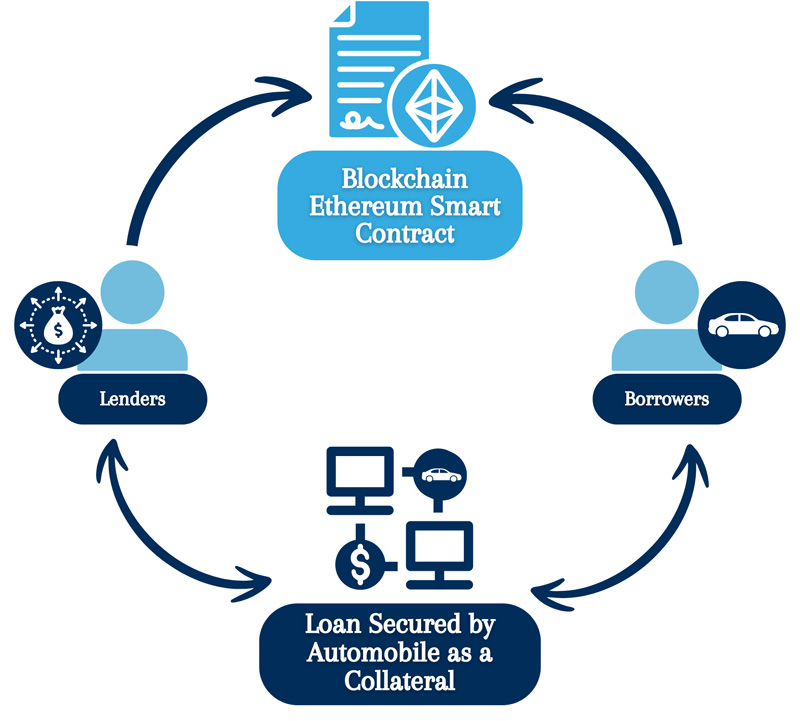

Peer-to-peer (P2P) lending for car purchases, utilizing car titles as collateral, offers a dynamic avenue for private lenders and borrowers to engage in mutually beneficial transactions. Private lenders, leveraging online platforms, assess potential borrowers' profiles, including credit history and the vehicle's value against the loan amount. With the collateral of the car title, lenders mitigate risk, making the investment enticing.

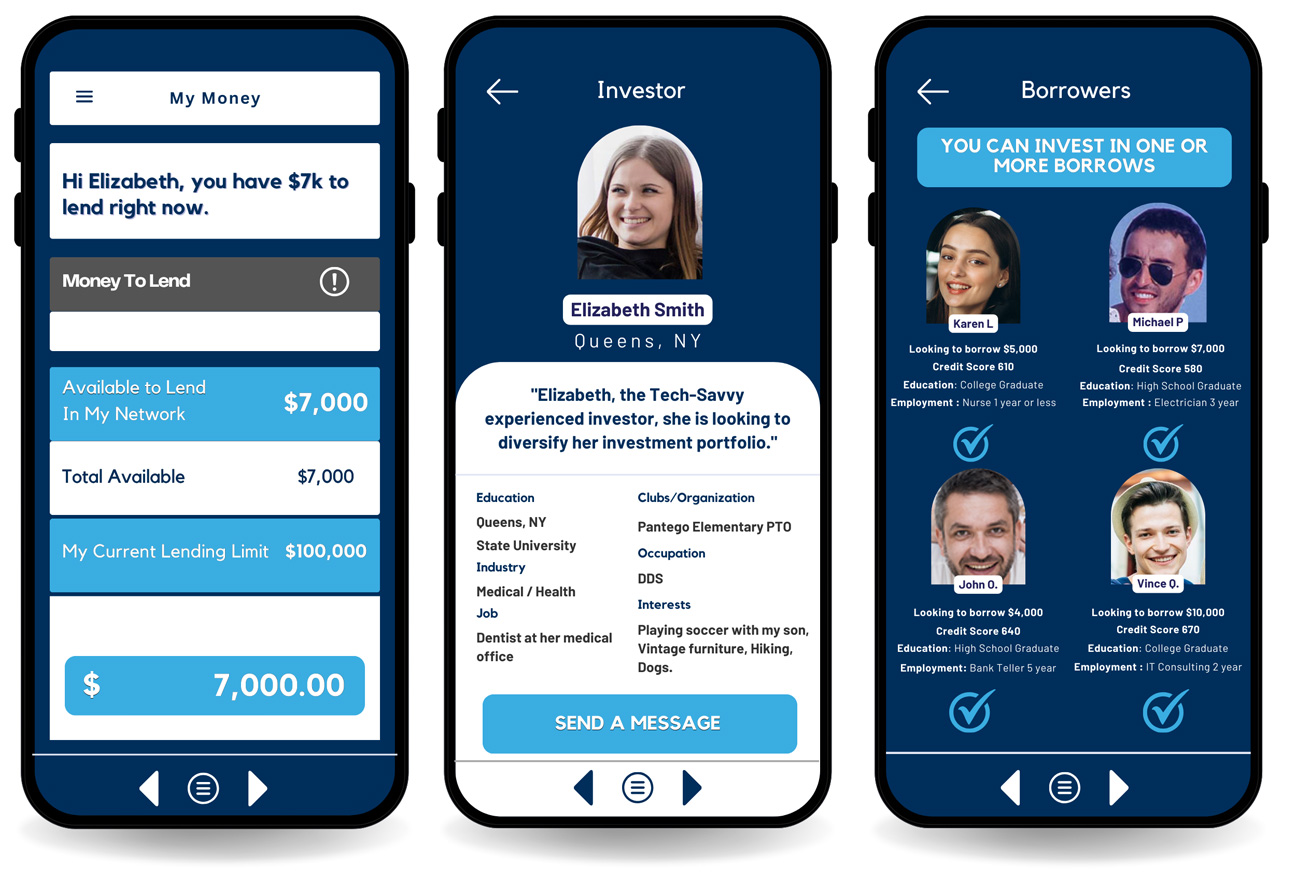

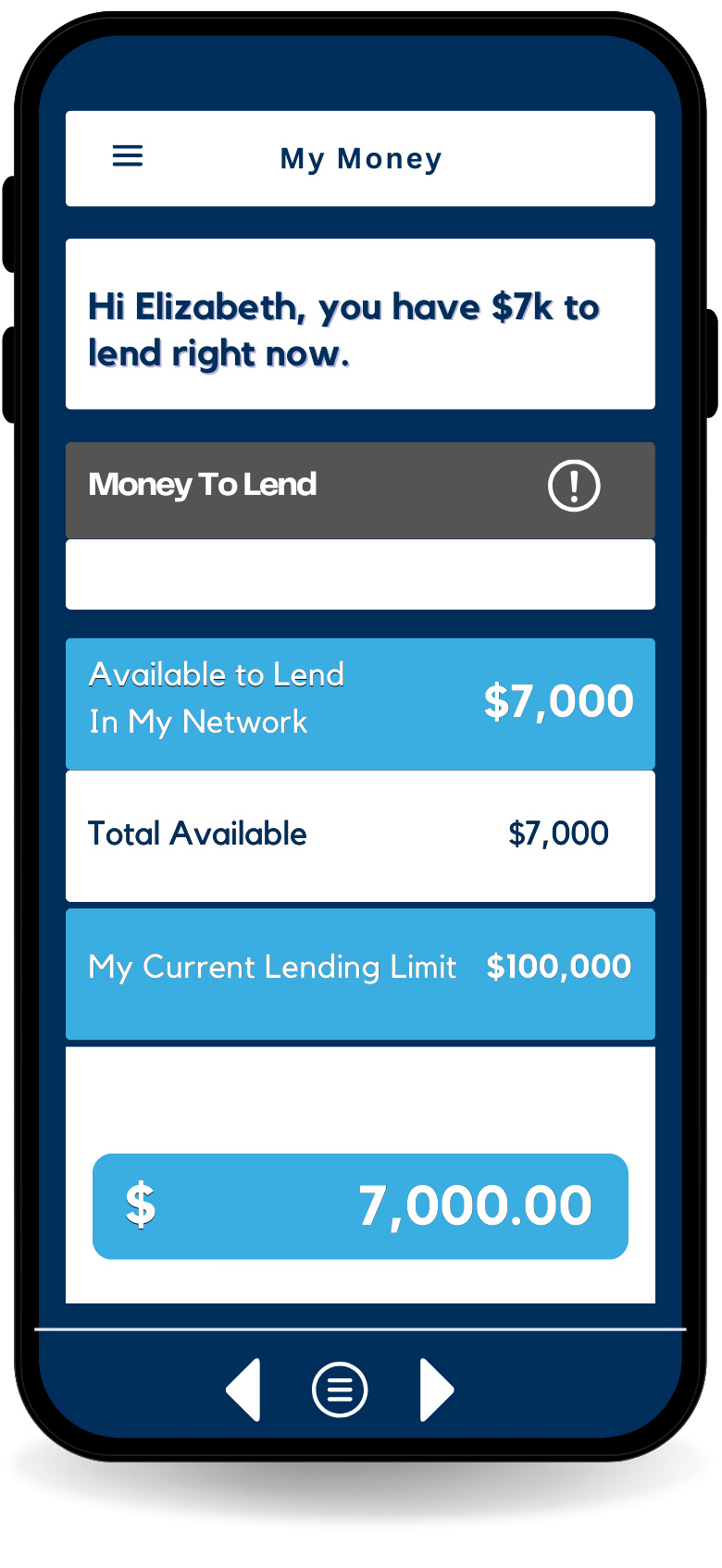

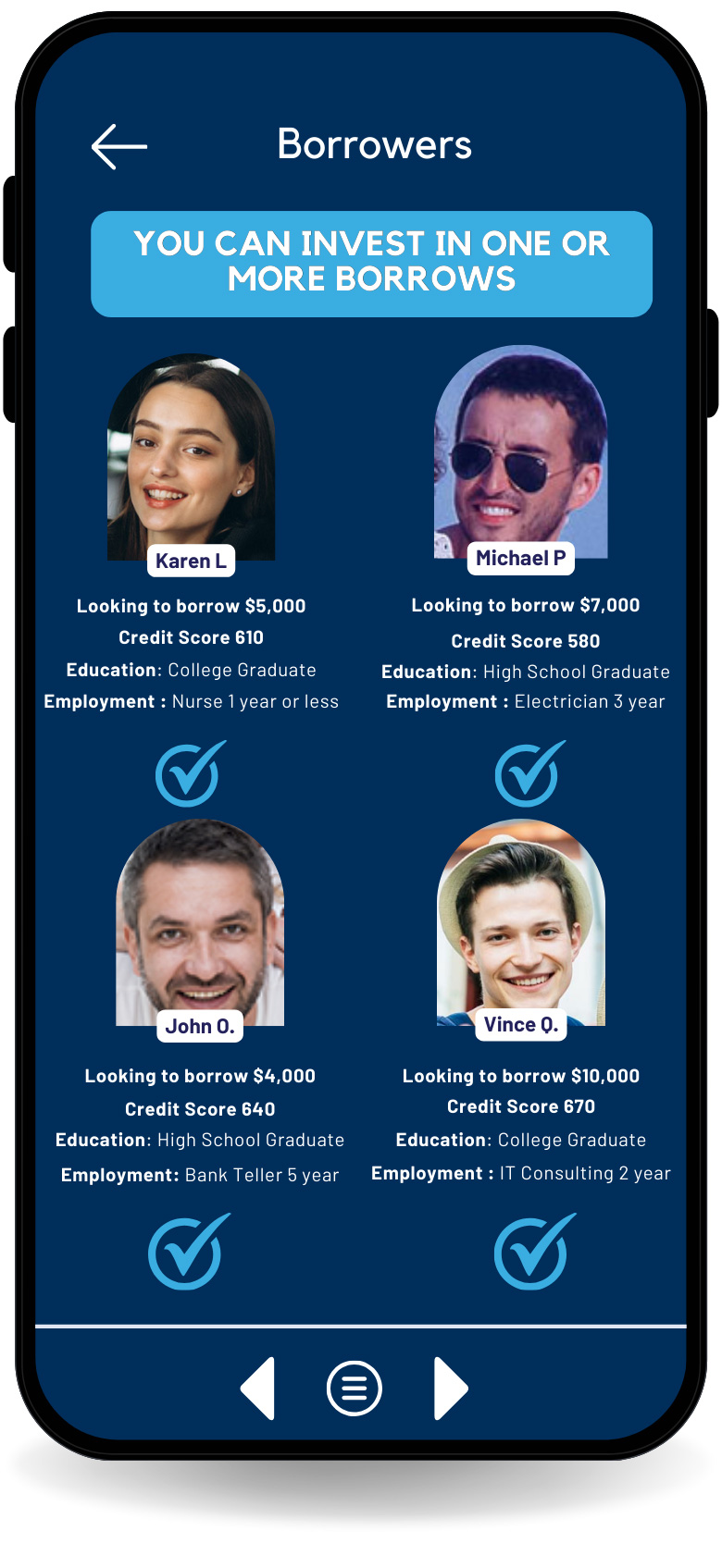

Diversification is a key strategy for lenders. By spreading their investments across multiple borrowers, they minimize exposure to individual default risks. P2P platforms facilitate this diversification by offering a range of borrowers with varying risk profiles and loan requirements. Lenders can allocate funds across different loans based on their risk appetite and return expectations.

For borrowers, P2P lending provides an alternative financing option with potentially competitive interest rates compared to traditional lenders. The process is streamlined, with online platforms offering convenience and accessibility.

In the event of default, lenders can repossess the vehicle, safeguarding their investment. However, the goal is for borrowers to fulfill their repayment obligations, maintaining trust and fostering a positive lending environment.

Overall, P2P lending with car title collateral empowers both lenders and borrowers by facilitating efficient transactions, risk mitigation through diversification, and accessible financing for car purchases.